Table of Content

However, they have expanded eligibility requirements that will accept bad credit and low income, low interest rates that keep your monthly payments cheap, and no down payment requirement whatsoever. Landed recently announced it is teaming up with the College Football Playoff Foundation and the Bay Area Host Committee to offer teachers and other school employees financial coaching and down payment assistance. The drawbacks of VA home loans include a one-time VA funding fee that you may need to pay, as well as a complex process. A good place to start if you want to learn more is to review the VA loan eligibility requirements.

The assistance and patience from this group is highly commendable; They were very helpful throughout the whole process. Visit the Find a Loan Officer tab, to contact a loan officer in your area. Only one occupying first-time borrower on each loan transaction.

VA Home Loans

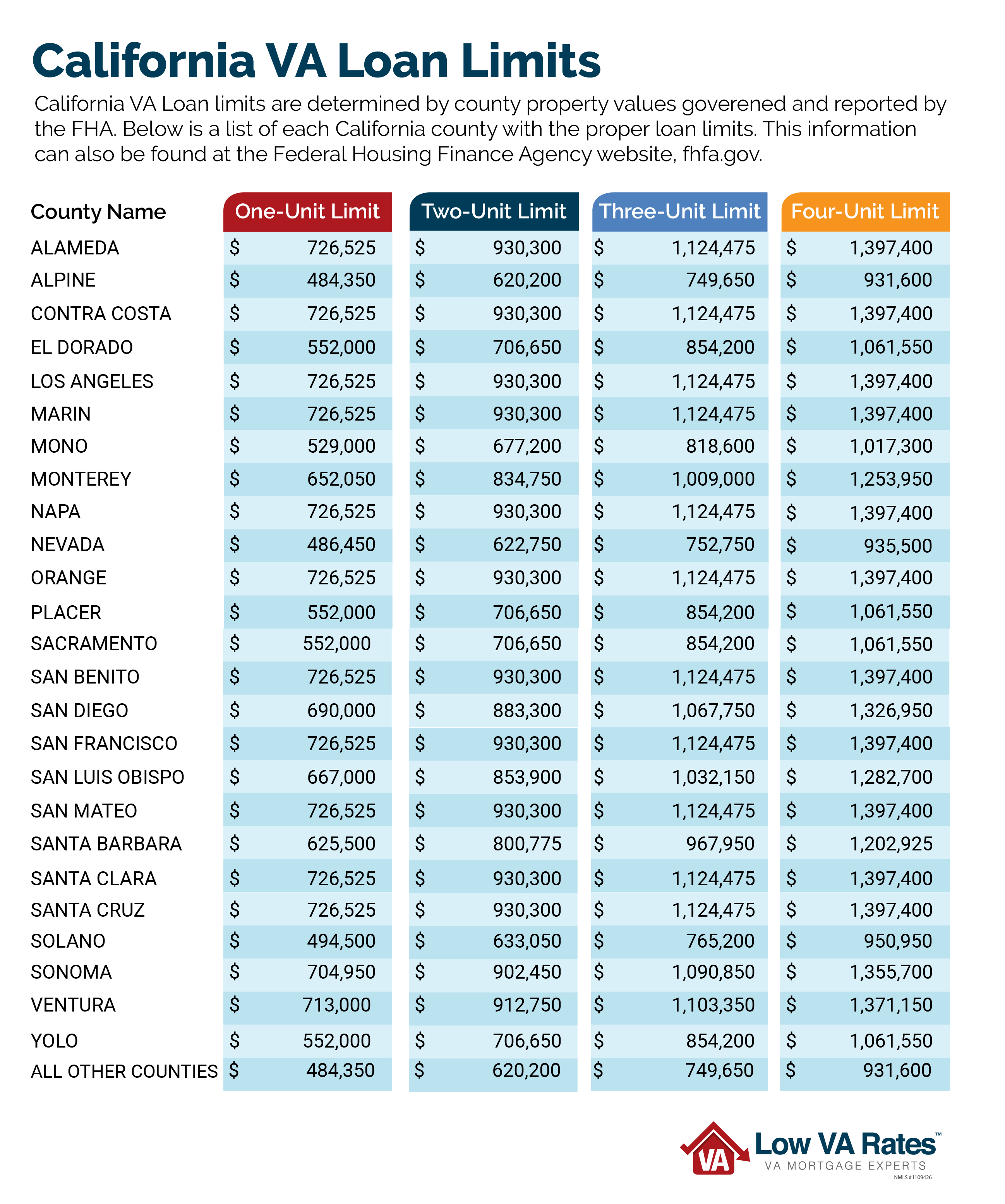

Sounds to me like the state has figured out a way to financially bury these poor teachers, make them beholden to the state. Itizen’s Power Network, whicheducates students on the importance of voting and civic engagement, would not have had enough money to purchase their first home without the assistance. One of the drawbacks of FHA loans is that they have maximum loan limits, which vary by county. This may be a problem if you’re looking to buy a home priced above the limit.

Between grading papers, creating assignments, keeping your students focused, and all the late hours spent in your classroom, your work is never done. Our team at Hero Home Programs™ is here to help you get into your dream home. You spend your days serving others, and we want to give back to you. There’s no obligation, and getting started takes just a few minutes.

CalSTRS Property Requirements

But with these resources and the help of intelligent counseling, we know you’ll be able to find the home of your dreams at an affordable price. You may find programs available to residents of your city or county, whether public or private. Landed, for example, offers down payment assistance to teachers living in certain high-cost cities, such as Seattle, Los Angeles, and San Francisco.

Teacher Next Door will also assist you with your loan application, helping to streamline the process by working with you on your purchase, financing, and closing paperwork. The CalSTRS 80/17 teacher purchase loan is a combo loan where a first loan is set at 80% LTV of the homes sales price and a second mortgage is set at 17% CLTV. If you are a teacher in California and a current homeowner, you can borrow up to 80% of the value of your home to pay off current student loans, credit card balances, or you can use the funds for home improvement. We value, honor, recognize, and reward those who educate our community. We think this is a great way of helping teachers make their home financing affordable.

Alternative Programs

The money you put "down" or the down payment on your home loan can be one of the largest hurdles for many first-time homebuyers. That's why CalHFA offers several options for down payment and closing cost assistance. This type of assistance is often called a second or subordinate loan. CalHFA's subordinate loans are "silent seconds", meaning payments on this loan are deferred so you do not have to make a payment on this assistance until your home is sold, refinanced or paid in full. This helps to keep your monthly mortgage payment affordable.

In addition to the $17,850 down payment loan, Perez and her fiancé Anthony Caro obtained a 30-year CalPLUSconventional mortgage for $492,150 at about 4.6 percent interest through the same state agency. They also got a smaller Zero Interest Program loan, known as a ZIP loan, for about $20,000 that helped pay for closing costs. All told, the assistance totaled about $530,000, including the mortgage. 2 The Educator Mortgage Program through Supreme Lending entitles the eligible home buyer and/or seller to a credit against real estate fees equal to .20% of the loan amount up to a maximum of $800. Supreme Lending will make best efforts to identify a participating Real Estate Agent but does not guarantee Real Estate Agent participation.

The solution should be to lessen the teacher’s burden not a high mortage and high debts. Please give more details and shade a light between the lines. Congratulation Mitzy and to all the teachers who have accomplished this goal and dream to have their own home. Landed, which lends funds for a down payment that is repaid when the home sells including a percentage of profit or loss. If so, please make your donation today to keep us going without a paywall or ads.

If you have retired or can prove that you previously worked as a teacher, you are still eligible. We price our loans with low average margins so you can get a great interest rate without having to worry about shopping. However, this can be a little risky for the co-signer, who will absorb some of the risk and may be expected to pay for you if you fail to make one of your monthly payments. There is no way a new teacher will be able to afford a $3,500 with the current teacher pay.

At Home Loans For All, we can help you find what you need. I would like to ask if this home assistant programs apply to all teachers from traditional and charter schools. I would like to get information to share it with teachers in general, no matter what school they are teaching. $118,000 to $228,300 — depending on the county in which they live. As deferred loans, they are repaid when the buyer sells or refinances the home. To qualify, your income can’t exceed 115% of the median household income in your area and you must live in the home as your primary residence.

If you have a troubled credit history, the Fresh Start program, which is part of Teacher Next Door, might help you get the mortgage you want. Some reviews are downright glowing, crediting a TND case manager with finding thousands of dollars in grant money that the home buyer never expected to receive. Good Neighbor Next Door helps law enforcement officers, firefighters, and EMTs as well as teachers.

Occupy the property as a primary residence; non-occupant co-borrowers are not allowed. Chat with us online or stop by a local branch to talk with one of our experts. Educators, here’s a mortgage program designed just for you. Your Teacher Next Door Program Specialist will help you find the perfect home with the best financing program available. No matter your profession, housing affordability is a local issue because home prices vary widely across the country. As the name implies, Teacher Next Door is tailored to educators.

Patriot Pacific Financial Corp & Brad Yzermans are licensed to lend in California. The MCTM program is an alternative to CalSTRS and other programs if you cannot met CalPATH criteria. Buyers can also combine the CalHFA down payment assistance program with the MCTM.

The Good Teacher Next Door program is actually a nationwide home buying program that enables teachers to purchase homes for 50% off the listed sale price. This program is officially referred to as the Good Neighbor Next Door . As savvy readers have probably picked up on, if you get an FHA loan with a 3.5 percent down payment, this program means that you won’t have to put any money down at all when you buy your California home. If you have a credit score between 500 and 579, you will need to provide alternative credit or make a 10 percent down payment. In any case, you’re likely saving a few thousand dollars up front.

USDA-guaranteed loans also let you buy with no down payment. And they offer lower interest rates and mortgage insurance rates than most other loan types. Some states have problems recruiting or retaining teachers. A number of those states offer special home loans for teachers as an incentive to move into certain school districts. Make sure you compare Supreme’s overall rate and costs with other lenders. You may be able to save more than $1,600 with another lender if it has significantly lower rates and fees.

No comments:

Post a Comment